Written by Kayla Jane Barrie Updated on Feb 21, 2025 5 mins read

Did you know you will be fined or face other penalties if you are caught driving without insurance in Ontario?

Even with the repercussions, some people drive without coverage. This is one of the many factors that lead to higher costs.

Undoubtedly, if you drive without it, you face serious consequences. When discussing the topic of not having an active policy, Ontario drivers are interested in four main things:

The following answers common questions about driving without insurance in Ontario, including fines, penalties, consequences, and the potential impact on your car insurance in Ontario.

Driving without insurance is something you should never do. It is estimated that more than 2,000 uninsured vehicles are involved in accidents each year in Ontario, and about 2% of all drivers do not have proper protection, according to a Toronto Star Investigation.

Under section 2 of the CAIA:

2 (1) Subject to the regulations, no owner or lessee of a motor vehicle shall,

Here is what you need to know about the fines for driving a vehicle without valid Ontario car insurance.

Section 3 of the CAIA outlines the penalty:

(3) Every owner or lessee of a motor vehicle who,

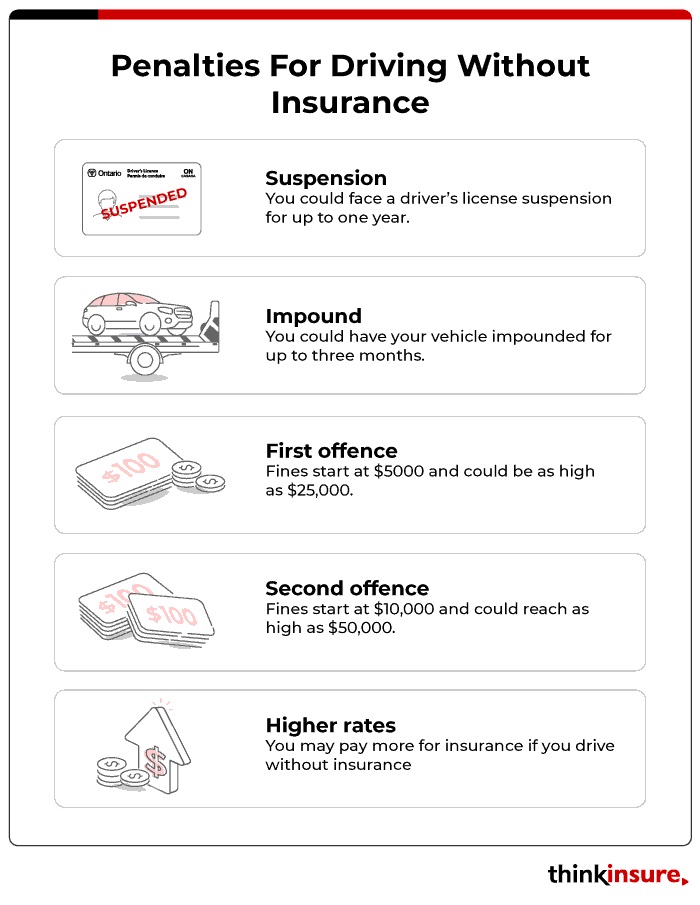

The fine for driving without it in Ontario varies based on the offence:

In addition to fines, there are other penalties for driving without insurance. They include:

No, driving without it is not a criminal offence in Canada. It is an offence under the Compulsory Automobile Insurance Act of Ontario (CAIA), meaning that if you are caught, you could face significant fines, but it will not go on your criminal record.

Even though you will not be arrested (unless you are involved in a criminal act when you are caught), you face a series of fines and penalties.

As part of your first offence for driving without insurance, your driver’s licence will be suspended for a minimum of 30 days. You could lose your driver’s licence for up to one year.

There are no demerit points for driving without insurance. But, as stated above, you will be fined.

There is a significant difference between driving without valid insurance and failure to show proof of insurance. You can receive a ticket for both infractions, but the fines for not having it are much more severe.

No, things like driving your parents' car and not having your own insurance are not an issue. As long as your parents have an active policy attached to the vehicle, you can drive it. If the police pull you over, you will have to show proof.

If you are keeping a vehicle, but will not be driving it, you won't require collision insurance but it is a good idea to have comprehensive insurance to protect it from risks associated with a parked car including a fallen tree, weather damage, or theft.

For some, driving without a valid policy may be unintentional. It is imperative to make sure that your insurance does not lapse when switching insurers. Even having a week or a day without it is all it takes to get fined. Learn more about how to cancel your insurance properly to avoid not being insured when you switch providers.

While the chances of getting caught without insurance are difficult to determine, it’s not worth the risk. No matter how well you drive, you are always at risk. You could be pulled over by the police unexpectedly or you could be hit by another vehicle.

This is perhaps one of the worst situations you can be in if you are driving without an active policy. If you are involved in an accident, you will be held personally responsible for all the repairs to your vehicle as well as any medical bills. Depending on the amount of damage or type of injuries, this could be a significant cost to you.

You will also be fined or face charges if you are found to be held responsible for an at-fault accident.

If you are fined for driving without it, getting insured after the incident will be difficult. Many companies will choose not to insure you and you may require high-risk car insurance.

Yes, your licence can get suspended if you are caught driving without valid insurance on your vehicle.

If you get into an accident and do not have proper coverage, you'll be held responsible for your repairs and medical bills. If you are found at-fault, you'll also be liable for any costs towards the other driver's vehicle, medical expenses, and even loss of wages. Don't forget finding a lower rate will be difficult.

| Categories | Auto |

|---|---|

| Tags | Auto Coverage |

Checkout our latest articles on insurance and other helpful topics.

Are you wondering how much a careless driving ticket will affect your insurance in Ontario? Get our questions answered and learn how much you may see your rate go up.

Got a careless driving ticket in Ontario? Here’s everything you need to know about careless driving charges, fines, and penalties.

You may not have control over the rain, but you can control how you handle hydroplaning (aquaplaning). Here’s how hydroplaning can happen and what to do to prevent it.

Our experts offer 25 safety tips for driving in the rain. You’ll discover the best lights to use, what speed limit to follow, how to drive safe when it’s raining.